malaysia personal income tax rate 2018

Personal Tax Reliefs in Malaysia. Exempt until 31st march 2018Capital gains more.

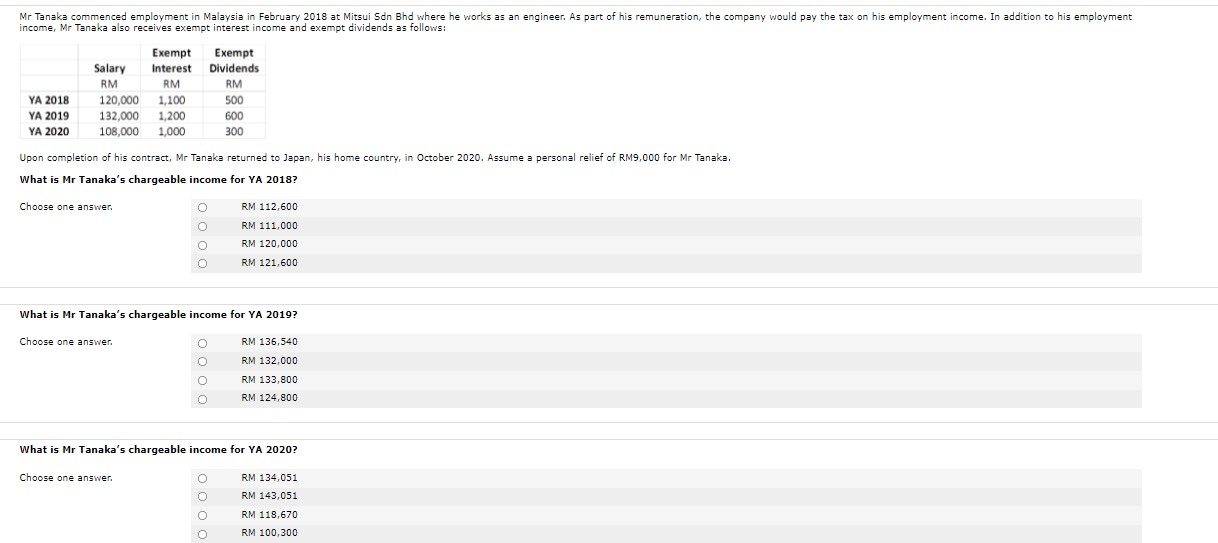

Tax Rates And Allowances The Following Tax Rates Chegg Com

Malaysia Personal Income Tax Rate.

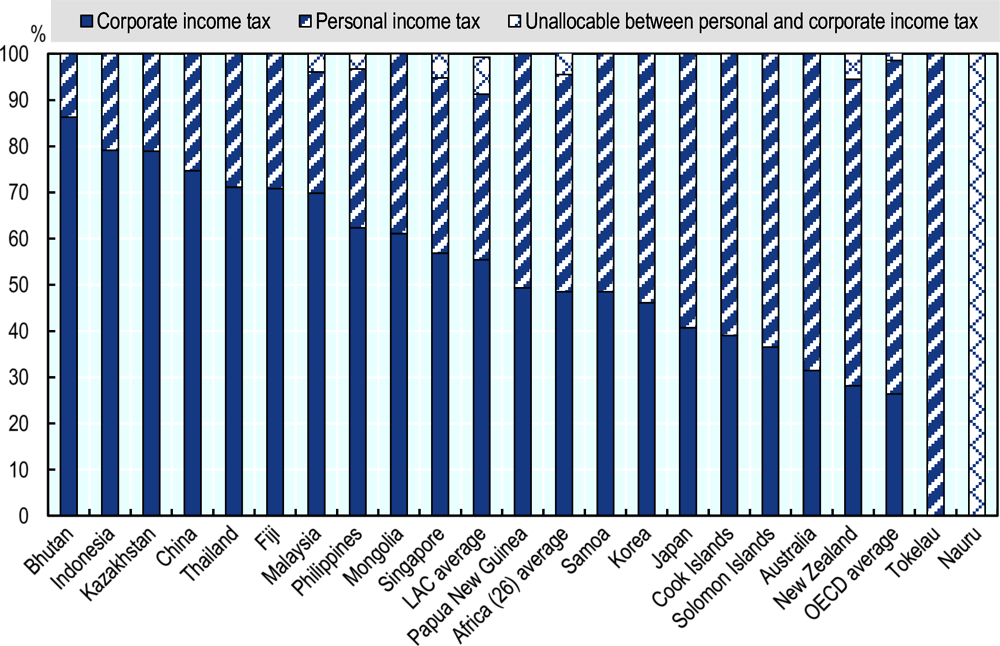

. For instance a manufacturing company with a pioneer status tax incentive pays an effective tax at the rate of 72 as only 30 of its profits are subject to tax. A non-resident individual is taxed at a maximum tax rate of 28 on income earnedreceived from Malaysia. The system is thus based on the taxpayers ability to pay.

Under the old income tax regime a higher tax exemption limit is available to senior citizens and super senior citizens. Historical statutory personal income tax rates and thresholds 1981-99 Central government personal income tax rates and thresholds 1981-1999 Sub-central personal income tax rates - non-progressive systems 1981-1999 Sub-central personal income tax rates - progressive system 1981-1999 Published. In tabling Budget 2023 Tengku Zafrul said that this would mean those in the aforementioned bracket would have their income tax payable rate slashed from 13 per cent to 11 per cent and 21 per cent to 19 per cent for those earning between RM70001 and RM100000.

For tax years after 31 December 2019 an individuals total tax will be 95 of ones total tax determined regular tax plus gradual adjustment if gross income exceeds USD 100000. Income Tax - Know about Govt of Indias Income tax guide rules tax efiling online slabs refund deductions exemptions calculations types of taxes FY 2022-23. In the process of filing Form B a sole proprietor needs to prepare various information to determine the chargeable.

The IRS will provide a copy of a gift tax return when Form 4506 Request for Copy of Tax Return is properly completed and submitted with substantiation and payment. A Microsoft 365 subscription offers an ad-free interface custom domains enhanced security options the full desktop version of Office and 1. Taxation and GST Planning for Investment Property in Malaysia.

Disposable Personal Income in the United States increased to 1866833 USD Billion in August from 1860071 USD Billion in July of 2022. Taxation is based on net income at a marginal tax rate of 78 which comprises the ordinary 22 CIT rate and a 56 special tax. This means that low-income earners are imposed with a lower tax rate compared to those with a higher income.

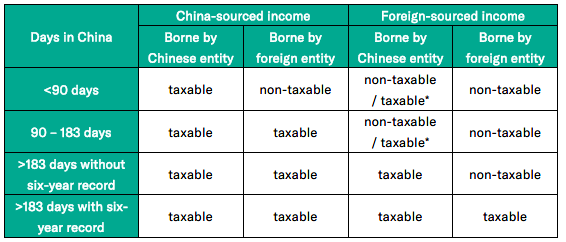

Given below are the income tax rates for FY 2021-22 AY 2022-23 and FY 2022-23 under the old tax regime. Malaysian Taxation on Foreign-Sourced Income. The stress-test rate consistently increased until its peak of 534 in May 2018 and it was not changed until July 2019 in which for the.

Public Bank and Public Islamic Bank To Increase Its Loan Financing Reference Rates By 025 Public Bank will increase its Standardised Base Rate SBR Base Rate BR and Base Lending Rate BLR Base Financing Rate BFR by 025 effective 12 September 2022 in line with Bank Negara Malaysias Overnight Policy Rate OPR hike by 25 basis points from 225 to 250 on. Income tax deduction implies lowering tax liability to the extent of interest rate paid for the mortgage loan. Disposable Personal Income in the United States averaged 596313 USD Billion from 1959 until 2022 reaching an all time high of 2182663 USD Billion in March of 2021 and a record low of 35154 USD Billion in January of 1959.

An application for the tax exemption can be submitted to Talent Corporation Malaysia Berhad from 1 January 2018 to 31 December 2023. Tax is calculated in accordance with a progressive table ranging from 8 on taxable income in excess of EUR 11265 to 42 on income in excess of EUR 200004 since 2018. Remittances of foreign-source income into Malaysia by tax residents of Malaysia are not subject.

Malaysia Personal Income Tax Guide. Upon receipt and verification including matching current taxpayer and taxpayer representative records with the information on the submitted Form 4506-T a copy of the original. Gross domestic product GDP is the market value of all final goods and services from a nation in a given year.

There are also differences between tax exemptions tax reliefs tax rebates and tax deductibles so make. Income tax filing for sole proprietors is straightforward. This article is a list of the countries of the world by gross domestic product GDP at purchasing power parity PPP per capita ie the PPP value of all final goods and services produced within an economy in a given year divided by the average or mid-year population for the same year.

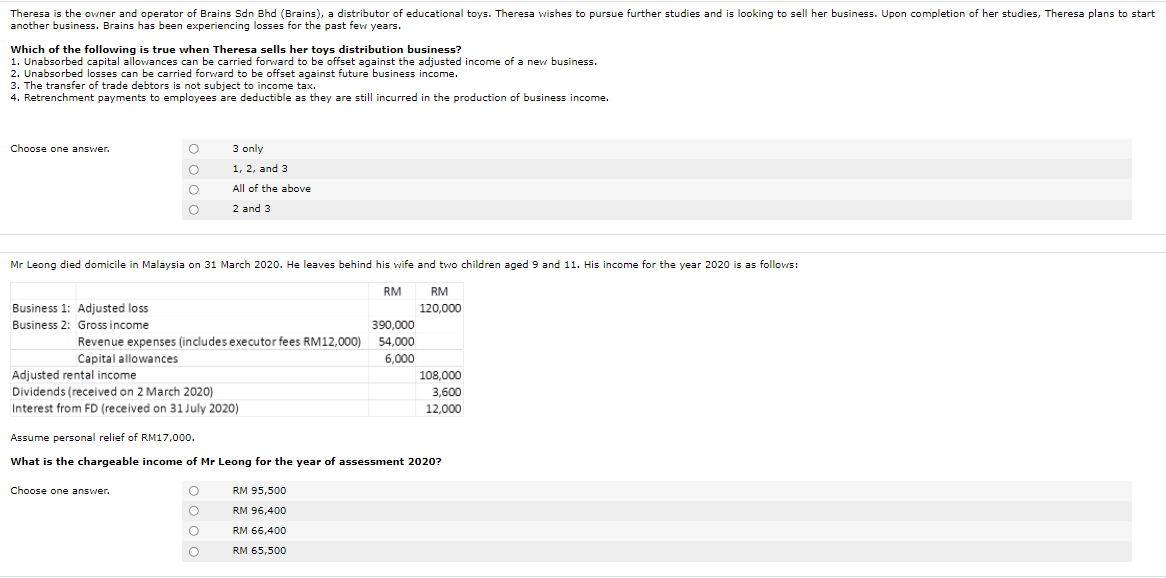

Instead of filing Form BE which is filed by individuals under employment or having non-business income sole proprietors file Form B before 30 June on a yearly basis. Dec22 Mauritania 40. Malaysia follows a progressive tax rate from 0 to 28.

Some of the major tax incentives available in Malaysia are the Pioneer Status PS Investment Tax Allowance ITA and Reinvestment Allowance RA. All income is subject to 22 CIT while only income from offshore production and pipeline transportation of petroleum from the NCS offshore tax regime is subject to the additional 56 special tax. Personal income in the United States rose by 04 percent from a month earlier in September 2022 the same pace as in August and slightly above market expectations of 03 percent primarily due to increases in compensation and personal income receipts on assets.

If gross income is USD 100000 or less then the individuals total. List of Countries by Personal Income Tax Rate - provides a table with the latest tax rate figures for several countries including actual values forecasts statistics and historical data. Real Property Gains Tax RPGT in Malaysia.

Personal services associated with the use of intangible property. Guideline for Personal Tax Clearance Form CP21 CP22A CP22B. An individual is a non-resident under Malaysian tax law if heshe stay less than 182 days in Malaysia in a year regardless of hisher citizenship or nationality.

A solidarity tax of 7 of taxes 9 for taxpayers earning more than EUR 150000 in tax class 1 and 1a or more than EUR 300000 in tax class 2 must also be paid. Malaysia Personal Income Tax Rate. Dec22 Malta 35.

Where profits of a non-resident company are remitted in a tax year a remittance tax of 14 of the remittances is payable prior to 1 April 2018 it was at 10. Expat Tax Guides. Countries are sorted by nominal GDP estimates from financial and statistical institutions which are calculated at market or government official exchange ratesNominal GDP does not take into account differences in the cost of living in different countries and the.

Yonhap news articles produced by building a network covering domestic supplies in various newspapers broadcasting and government departments major institutions major corporations media K-pop K-wave Hallyu Korean Wave Korean pop Korean pop culture Korean culture Korean idol Korean movies Internet media and international agreements of the Republic of. An individual is considered a Senior Citizen if an individual crosses the age of 60 years during the financial year. This is similar to nominal GDP per capita but adjusted for the cost of living in each country.

There is no local or provincial income tax applicable to corporates in Sri Lanka. Compensation of employees rose 05 percent vs 03 percent in August led by private wages and salaries 06. List of Countries by Personal Income Tax Rate.

Malaysia Personal Income Tax Calculator for YA 2020 Malaysia adopts a progressive income tax rate system. A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first RM5000 to a maximum of 30 on chargeable income exceeding RM2000000 with effect from YA 2020. Weve developed a suite of premium Outlook features for people with advanced email and calendar needs.

Malaysian Income Tax 2017 Mypf My

Income Tax Formula Excel University

Doing Business In The United States Federal Tax Issues Pwc

Taxation In New Zealand Wikipedia

What You Need To Know About Payroll In Malaysia

Malaysia Personal Income Tax Rate Tax Rate In Malaysia

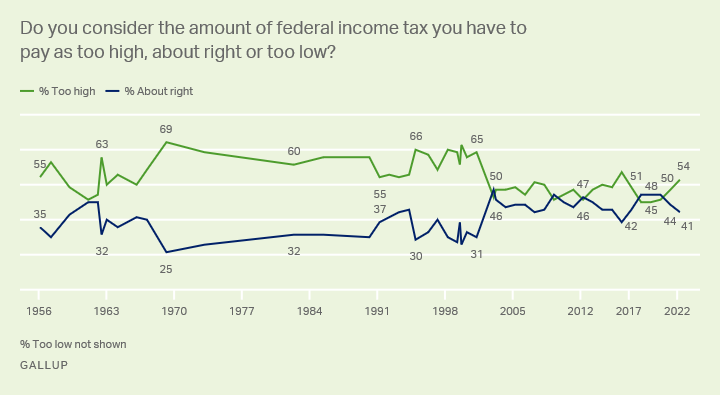

Taxes Gallup Historical Trends

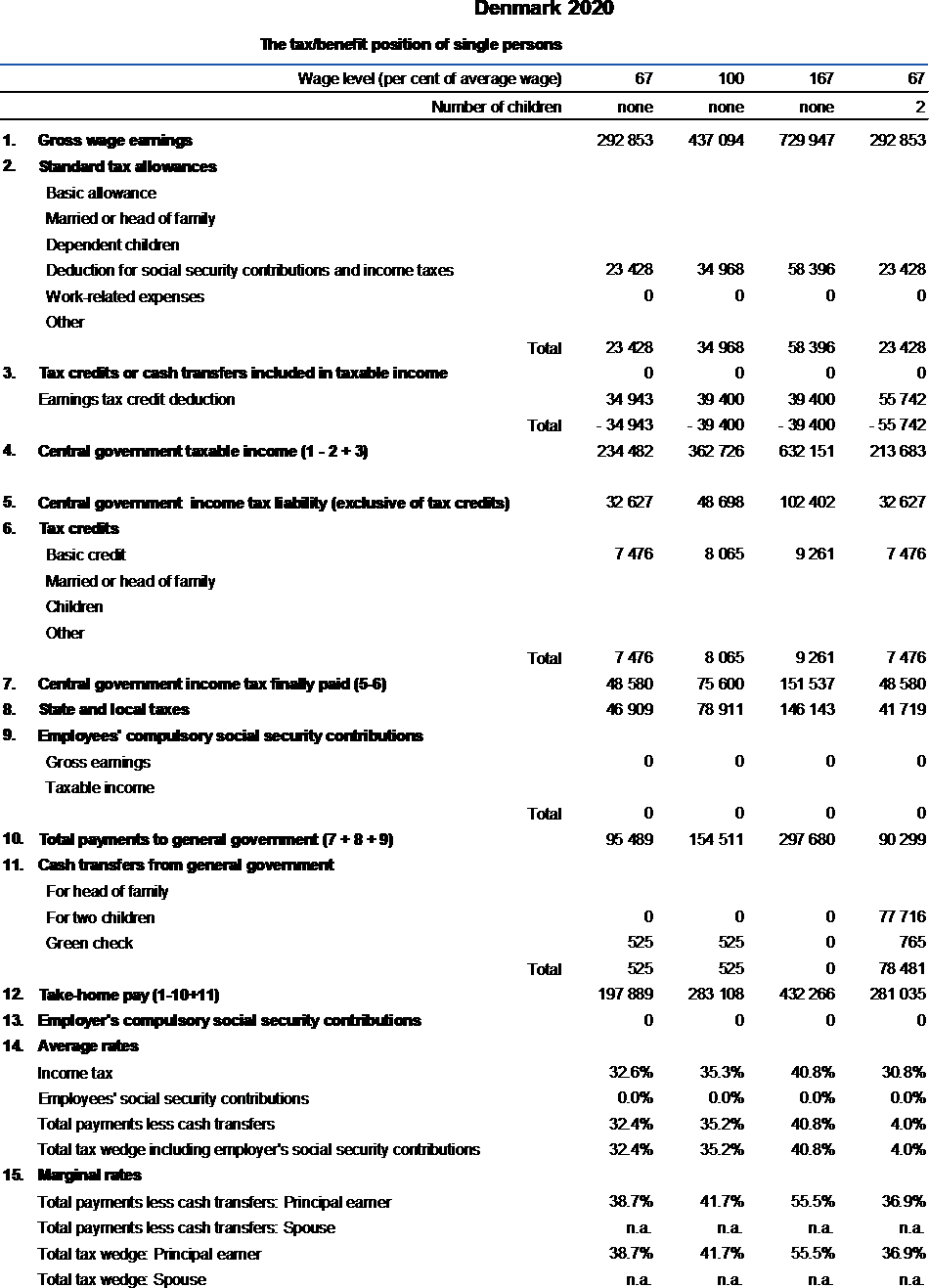

Denmark Taxing Wages 2021 Oecd Ilibrary

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Tax Rates For Year Of Assessment 2018 T Plctaxconsultants

The Revolution In China Individual Income Tax Law As Of 2019 Rodl Partner

Malaysia Personal Income Tax Rate Tax Rate In Malaysia

Rate 0 1 3 8 Individual Income Tax Rates Ya 2018 To Chegg Com

Individual Income Taxes Urban Institute

How Train Affects Tax Computation When Processing Payroll Philippines

2017 Personal Tax Incentives Relief For Expatriate In Malaysia

Comments

Post a Comment