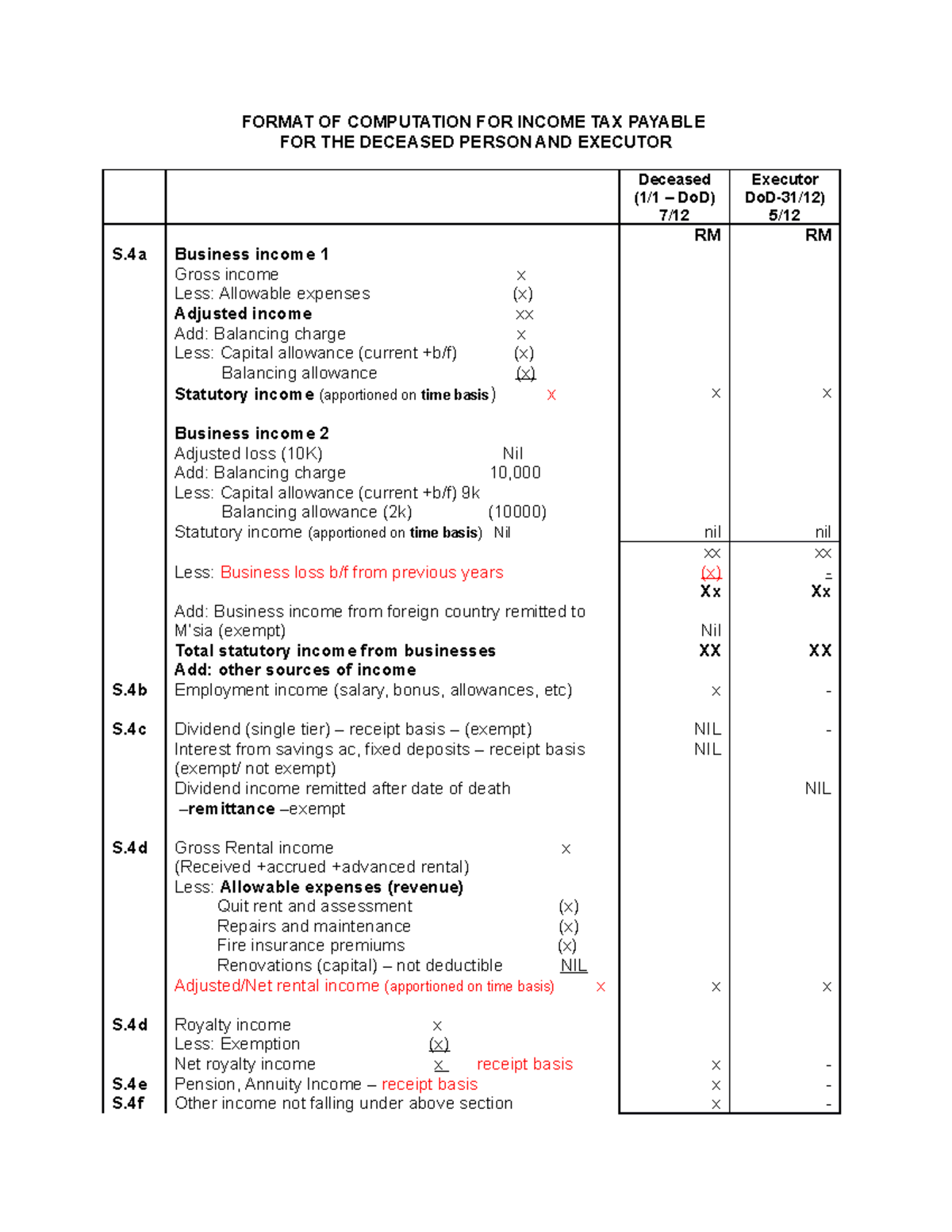

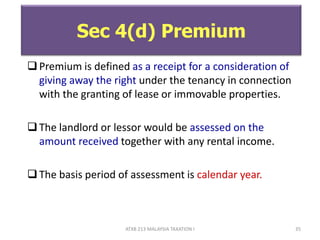

section 4d rental income tax computation

If youre renting a property for business purposes however your rental income is filed under Section 4. Section 4D Rental Income Tax Computation Https Joebiden Com Wp Content Uploads 2020 09 2019 Biden Delaware Virginia Federal 3 Pdf.

Computation For Individual Tax Liability For The Year Of Assessment 2019 Format Of Computation For Studocu

Life is complicated especially when it comes to career planning and financial security.

. Income Tax Computation In Excel For Finance Year 2017 18 Income Tax Com Income Tax Income Tax. Rental income tax is a tax imposed upon profit that you make from renting out properties. This was introduced in Section 4 d of the Income Tax Act 1967 ITA.

Ad Know what your tax refund will be with FreeTaxUSAs free tax return calculator. The idea is that income from the renting of residential. Rental deposit Generally forfeiture of the rental deposit is considered as part of your gross rent and is taxable.

Ad Prepare E-File Your 2021 Federal Tax Return For 14 Or Less. Come browse our large digital warehouse of free sample essays. Continue their fight for a progressive income tax or another tax measured by income.

Architecture Construction Engineering Software Tech More. However returns must be filed monthly. The Calculator can help you with immediate next steps and plan for your.

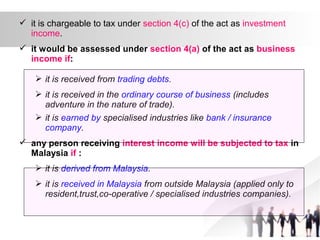

Rental income is filed under Section 4 d of the Income Tax Act 1967. Ad Prepare E-File Your 2021 Federal Tax Return For 14 Or Less. 12 the situations or circumstances where rent or income from the letting of property can be treated as business income of a person under section 4a of the Act.

If your rental income is assessed as a business income the rental losses can be utilised either to offset against other income in the same year or to be carried forward to subsequent years. See low income HUD and Section 8 apartments for rent within Candlewood Ridge in Renton WA with Apartment Finder - The Nations Trusted Source for Apartment Renters. Weve all heard the saying that.

Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly. Federal income tax brackets in 2001. Get the knowledge you need in order to pass your classes and more.

Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. Ad Aprio performs hundreds of RD Tax Credit studies each year. In Malaysia income derived from letting of real properties is taxable under paragraph 4a business income or 4d Rental income of the Income Tax Act 1967.

Income received from the letting of the real property is charged to tax as rental income under paragraph 4 d of the ITA. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. The exemption is applicable for.

And 13 how all. Income received from the letting of the real property is charged to tax as rental income under paragraph 4 d of the ITA. It is possible that in recent months the movement for a progressive income tax may have gotten a.

100s of Top Rated Local Professionals Waiting to Help You Today. Now in 2019 the time has come for property owners to begin claiming that exemption on their income tax forms. Ad Browse Discover Thousands of Law Book Titles for Less.

Rents out his residential properties at a rate below RM 2000 a month. Take the burden of sales tax compliance off your plate with help from Avalara AvaTax. Read this essay on Rental Income Tax Computation.

As of October 2022 the average apartment rent in Renton WA is 1277 for a studio 2266 for one bedroom 2753 for two bedrooms and 2966 for three bedrooms. Azrie owns 2 units of apartment and lets out those units. We dont selluse your info for anything except to preparefile your federal tax return.

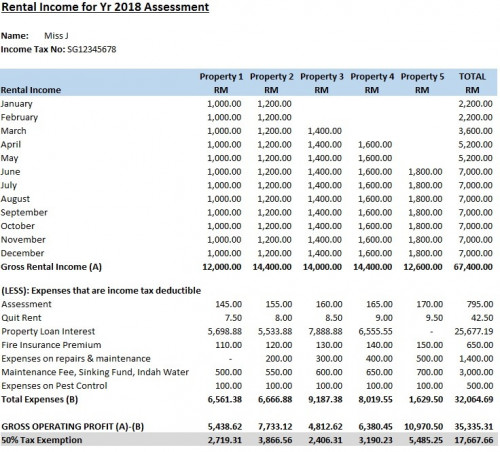

Section 4d rental income tax computation. Fourth Adam is able to claim 50 exemptions on the tax on rental income if he. As per Section 24A of the Income Tax Act a.

467 income rule if the amount. Section 4D Rental Income Tax Computation Https Joebiden Com Wp Content Uploads 2020 09 2019 Biden Delaware Virginia Federal 3 Pdf. We dont selluse your info for anything except to preparefile your federal tax return.

Ad Get the benefit of tax research and calculation experts with Avalara AvaTax software. Rental income tax is a tax imposed upon profit that you make from.

Rental Income Tax Malaysia And Other Tax Reliefs For Ya 2021

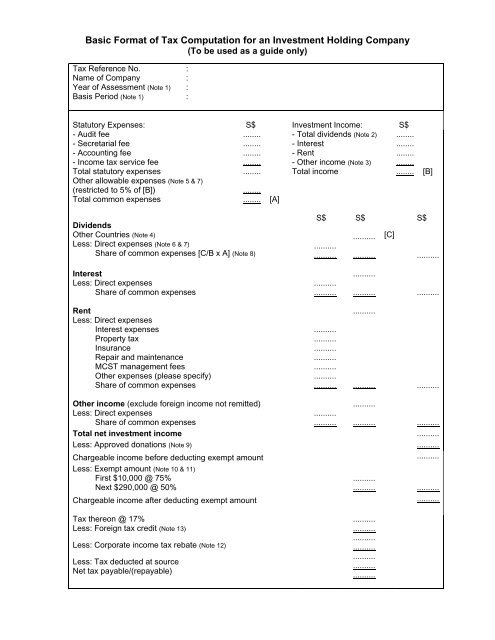

Basic Format Of Tax Computation For An Investment Holding Iras

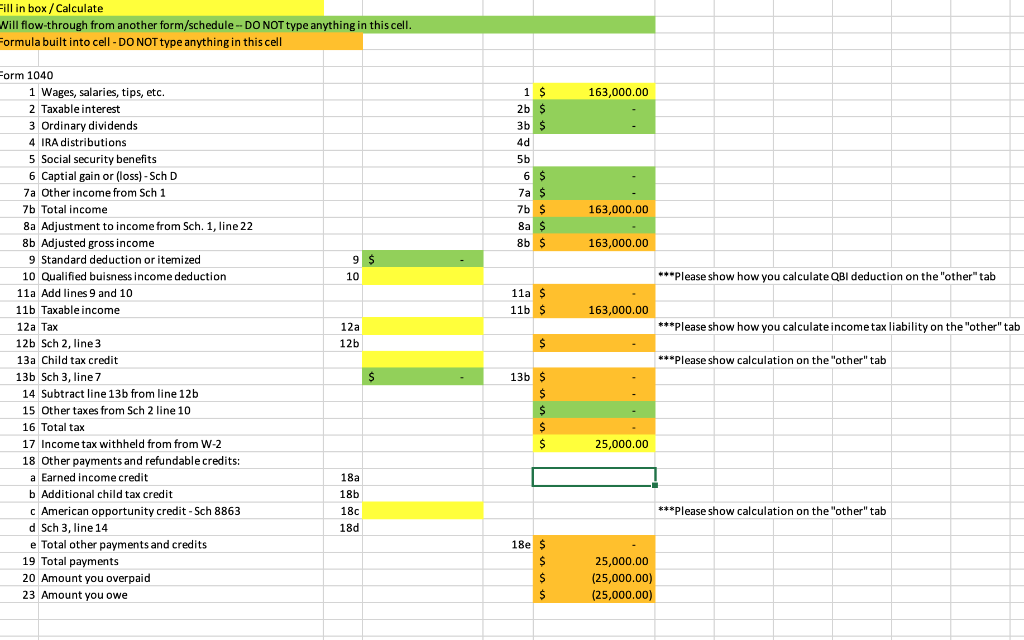

Acct 3307 002 003 Spring 2020 Tax Return Project Chegg Com

How To Calculate Taxable Income On Rental Properties 10 Steps

What Is An Investment Holding Company In Malaysia And 4 Benefits To Having One

Sec 199a And The Aggregation Of Trades Or Businesses

Sec Filing 4d Molecular Therapeutics

Special Tax Deduction On Rental Reduction

8 Things To Know When Declaring Rental Income To Lhdn

50 Tax Exemption For Rental Income 2018 2020

Ktp Company Plt Audit Tax Accountancy In Johor Bahru

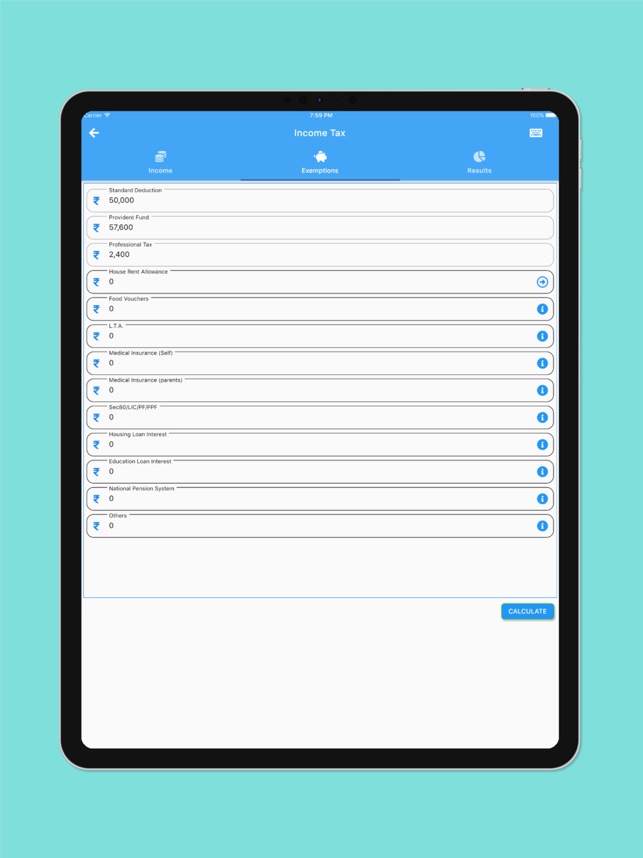

Tapraisal Income Tax Cal India On The App Store

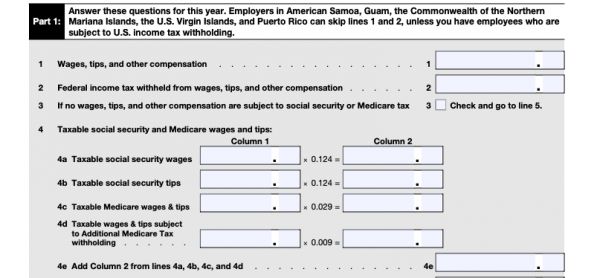

Irs Form 944 Instructions And Who Needs To File It Nerdwallet

Chapter 5 Non Business Income Students

3 11 14 Income Tax Returns For Estates And Trusts Forms 1041 1041 Qft And 1041 N Internal Revenue Service

Form I 864 Affidavit Of Support Help Center Chodorow Law Offices

Taxation Principles Dividend Interest Rental Royalty And Other So

Comments

Post a Comment